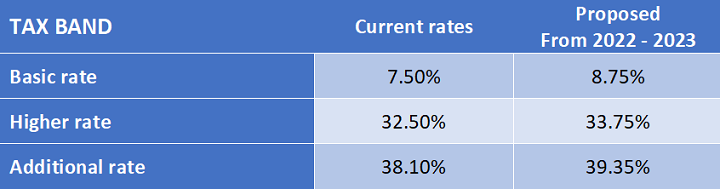

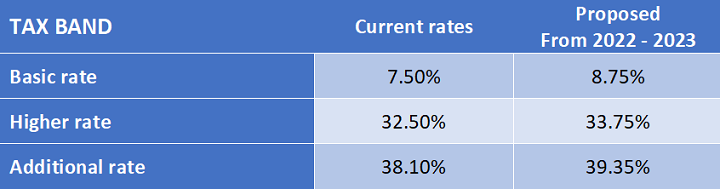

Rates on Income Tax applicable to Dividend Income

Legislation will be introduced in Finance Bill 2021-22 to change sections 8 and 9 of the Income Tax Act 2007 to increase the rates of tax applicable to dividend income including the dividend trust rate. This will also have the effect of raising the rate of tax charged under section 455, Corporation Tax Act 2010 on loans to participators.

The new measure will increase the rates of Income Tax applicable to dividend income and apply from 6 April 2022.

Currently any individual who has dividend income can benefit from the dividend allowance of £2,000 therefore dividends within the allowance are not charged to tax and this will remain the case.

The ordinary rate, upper rate and additional rate will increase each rate by 1.25% as follows: