In a nutshell the New Tax Res regime allows anyone who has not being tax resident in Italy for 9 out of 10 years to apply for an annual flat tax on all income generated on foreign assets. The flat tax includes indirect taxes too, such as Gift Tax or Inheritance tax or Wealth tax. It last for 15 years with the possibility to terminate early, but only once. A peculiar and specific rule set no issues for the remittance. The New Tax Res is free to import any income made abroad and spend or invest it in Italy.

Further benefit is the full privacy as the taxpayer is not going to be obligated to declare all his or her assets abroad, as a resident taxpayer usually does. The move gives an Italian tax residence, including the benefit of the treaty network, and gives room to update trust and estate planning in full tax compliance.

784 is a good number for the young Italian regime if you compare with other such as the UK non dom, the Swiss Forfait or other European regimes (e.g. Malta, Portugal, Luxembourg or Monaco).

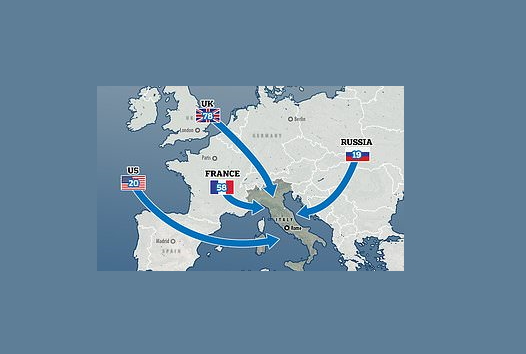

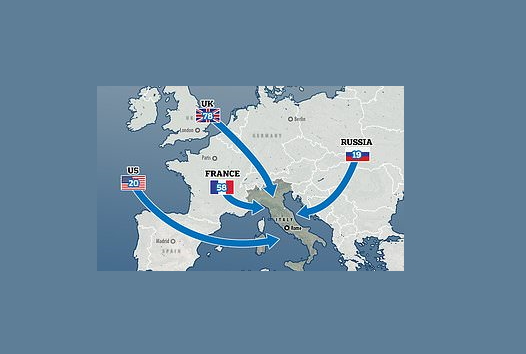

According to official Italian statistics, British HNWIs are leading the way (with 78 people leaving UK), followed by French (58), Switzerland (32), Brasil (25) but with a good number from Russia (19), Eastern Europe, Middle East and other countries from the Far East, the Latin America and even the US ( ) . The program is open to Italian citizen too.

Our Firm assisted the first cases during 2017, including the first case related to the investor visa program started on December 2017. Since the beginning we had several experience and some difficult cases which eventually passed through because of the possibility to structure an administrative ruling with the Tax authorities. Good news in Italy includes the new dialogue between taxpayer and Tax Office.

In order to enter the New Tax Res regime you have to obtain a resident permit. If you do not have an EU Passport, your way is the one of the Italian Investor Visa. It is a fast track to the Shengen visa, which is given to the applicant and for the entire family. It is a smooth process taking around 2 months and conditioned to one of the following: (i) investing €500k into an Italian company (including a stock listed company), halved if invested into an innovative company or start up (250k); (ii) investing €2M in Italian Treasury Bond; (iii) investing €1M in the Art Bonus scheme.

The “New Tax Res” 100k Flat Tax regime is not the only possibility. As an alternative and with different requirements it is possible to elect the regime applicable to retired individuals, setting a 7% tax rate on all income abroad, or the regimes designed to attract talents, brains and researchers which is attracting a consistent number of expats and global managers.

Should you are interested to further information you may find more reading this attachment HERE.

Our Partners and professionals Belluzzo International Partners in Milan, Verona, London, Lugano or Singapore are experience in legal and tax issues, including immigration and trust & estate planning, and are more than happy to further liaise with you and your advisors in order to explore the mechanics and the best practices related to these regimes. Only the Italian ones have specific ingredients: Italy!